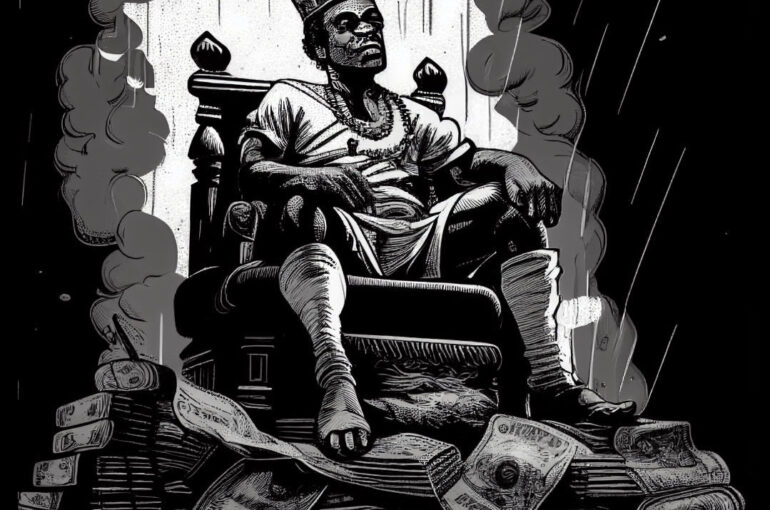

Ka-Ching! Cash remains king

Cash remains king, at least in Nigeria. When the Central Bank announced the redesign of the 200, 500 and 1,000 naira notes on 26 October 2022, even the pessimists did not expect it to be so chaotic.

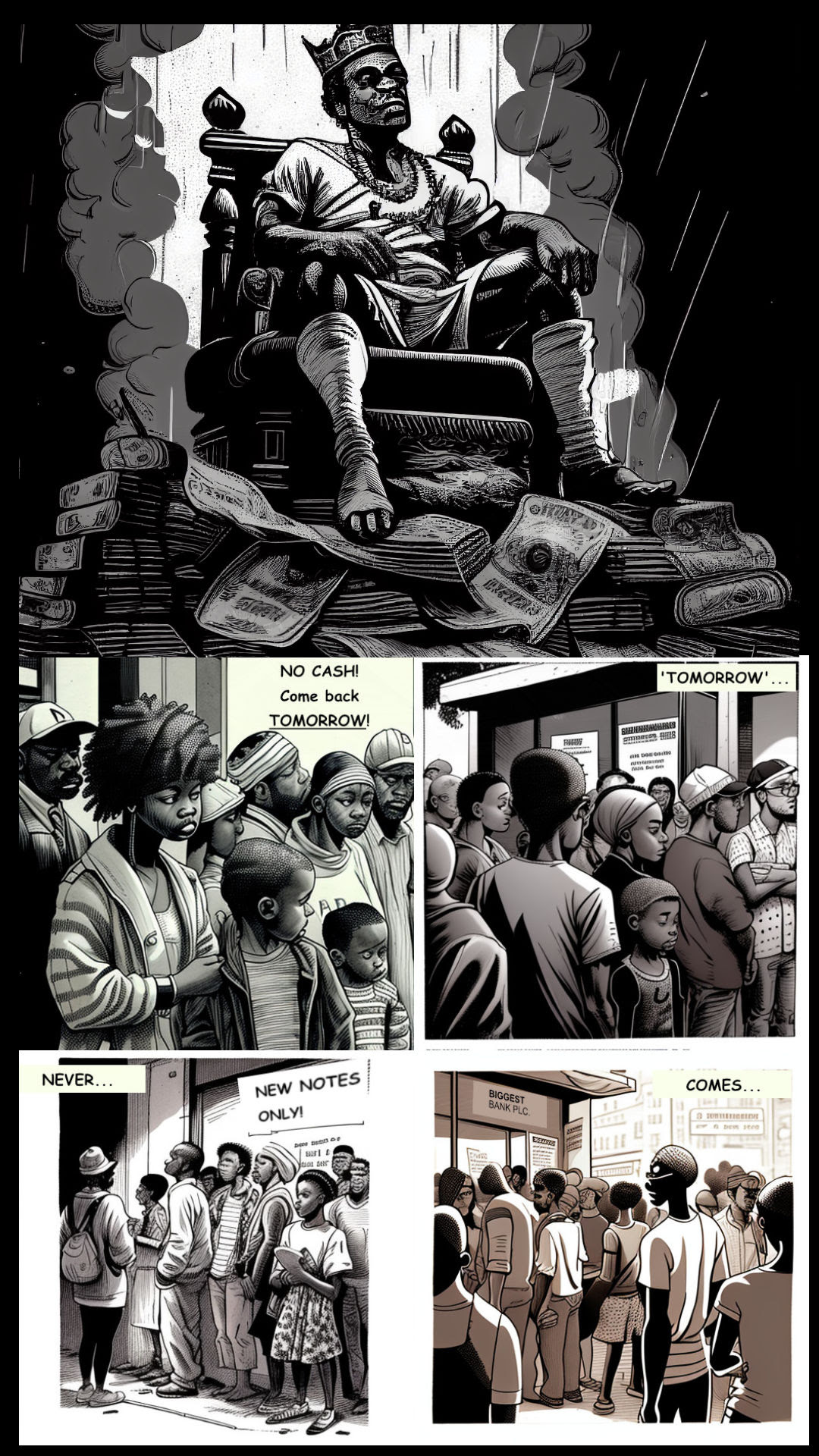

In the latest twist, the Supreme court suspended the Jan 31st 2023 deadline (which had been extended to February 10), President Buhari granted a 60-day extension for only N200 notes while the Kaduna state governor Nasir El-Rufai announced there was no deadline and all notes remained legal tender.

While policy flipflops are laughably familiar across Nigeria’s governance, these contradictions have been particularly cruel to Nigerians. Amidst rising cost of living, fuel and electricity shortages, a cash crunch so close to the elections when business slows down, was an avoidable additional hardship. While this will likely be “temporary pains” as CBN governor Godwin Emefiele has repeatedly said, this situation allows us to examine the impact of the chaos on e-banking and cashless policy.

Will people be more distrustful of the banking systems, or could this be the catalyst to mobile money in true Kenyan style? The recent chaotic scenes at ATMs, violent protests and arrest of POS agents in our view will set back the cashless agenda.

It is important to examine the role of the large banks in the failures of the past few weeks. Their channels have been slow or completely unresponsive for several weeks (just search Zenith or Access bank on Twitter for complaints), at a time when they are most needed.

For various reasons, these banks have stopped expanding their branch footprint, instead relying on expanding their agent banking network. While this isn’t necessarily bad, the recent challenges illustrate that e-banking channels and agent banks are not substitutes for physical banking channels.

What does this mean for the online banks, payment platforms, telcos, mobile money, and the development advocates of “banking the unbanked”?

Also, what went wrong with Micro-finance institutions in their role supporting the bottom of the pyramid, a decade of research, consumer education and a billion-naira ecosystem for payments?

They certainly all have their work cut out for them.

We have made some progress since Sanusi Lamido Sanusi, former CBN governor, launched the cashless policy in 2012. But as the last few weeks have shown, we have a long way to go and must temper our expectations on what digital finance can do.

The largest advancement in our view, is that most stakeholders accept that digital banking is here to stay-alongside, not in place of cash. The cash crunch will likely last long after the elections, with shortages of bank cards and poor services taking weeks to resolve, especially in the major cities.

For businesses in this space, we advise that effective communication, stakeholder engagement, advocacy and regulatory research must be ongoing.